Budgeting Made Simple: A Beginner’s Guide to Taking Control of Your Finances

Managing money can feel overwhelming, especially if you’re just starting out. Between bills, groceries, subscriptions, savings, and the occasional splurge, it’s easy to lose track of where your hard-earned cash goes. That’s where budgeting comes in. Far from being restrictive, a good budget gives you the power to control your finances, reduce stress, and reach your goals faster.

This beginner’s guide will walk you through everything you need to know to start budgeting confidently and effectively—from understanding what a budget really is to creating your own step-by-step plan that works for your lifestyle.

What Is Budgeting and Why Does It Matter?

Budgeting is the process of creating a plan for how you will spend your money. It helps ensure that you have enough for the things you need and value most, while avoiding debt or financial instability.

Here are a few key reasons why budgeting is important:

- Helps you track your spending

- Reduces financial stress and uncertainty

- Builds awareness of money habits

- Prepares you for emergencies

- Guides you toward financial goals (saving, investing, paying off debt)

Ultimately, budgeting is about being intentional with your money—not just letting it disappear without knowing where it went.

Step 1: Know Your Income

The first step in building a budget is understanding how much money you actually take home each month. This includes:

- Your main job’s net income (after taxes)

- Side hustles or freelance income

- Passive income (like dividends or rental earnings)

Tip: Use your net income (what you receive after taxes and deductions), not your gross income.

If your income varies from month to month, calculate an average based on the last 3 to 6 months to set a reliable baseline.

Step 2: Track Your Expenses

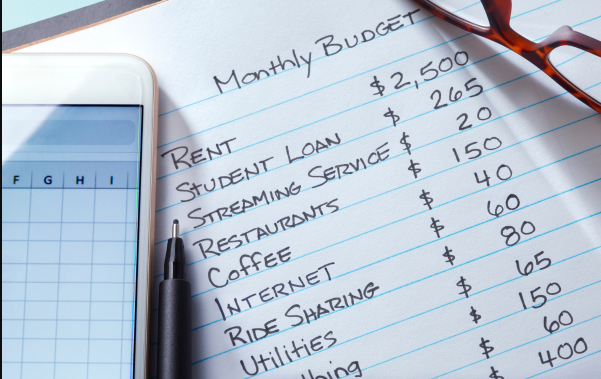

Before you can control your spending, you need to know where your money is going. Start by listing all your monthly expenses, both fixed and variable:

Fixed Expenses:

- Rent or mortgage

- Utility bills

- Insurance premiums

- Loan payments

- Internet and phone bills

Variable Expenses:

- Groceries

- Transportation (fuel, public transit)

- Dining out

- Entertainment and subscriptions

- Shopping and personal care

Tip: Review your bank statements or use an expense-tracking app like Mint, PocketGuard, or YNAB (You Need A Budget) to get a detailed picture of your spending habits.

Step 3: Categorize Your Spending

Now that you know what you’re spending, organize your expenses into categories. This makes it easier to see patterns and areas where you might overspend.

Common categories include:

- Housing

- Utilities

- Food and groceries

- Transportation

- Debt payments

- Savings and investments

- Entertainment

- Health and insurance

- Miscellaneous

Categorizing gives you a better sense of how your money flows and which areas can be adjusted.

Step 4: Choose a Budgeting Method

There are several popular budgeting methods. Pick one that fits your personality, income type, and financial goals.

1. The 50/30/20 Rule

This method splits your income into:

- 50% Needs: Rent, utilities, groceries, transportation

- 30% Wants: Dining out, hobbies, streaming services

- 20% Savings/Debt Repayment: Emergency fund, retirement, loans

This is great for beginners looking for a simple structure.

2. Zero-Based Budgeting

With this method, every dollar you earn is assigned a job—whether it’s for spending, saving, or paying down debt. Your income minus your expenses should equal zero at the end of the month.

3. Envelope System (Cash Budgeting)

You divide your money into envelopes labeled with specific spending categories. Once an envelope is empty, no more spending in that category for the month. Ideal for people who prefer cash or struggle with overspending.

4. Pay Yourself First

This approach prioritizes savings by allocating money for saving and investing first—before any other spending. It’s best for those focused on growing wealth.

Step 5: Create Your Monthly Budget Plan

Based on your income, expenses, and chosen method, build your monthly budget. Here’s a sample layout:

| Category | Budgeted Amount | Actual Amount |

|---|---|---|

| Rent/Mortgage | $1,000 | $1,000 |

| Utilities | $200 | $195 |

| Groceries | $400 | $450 |

| Transportation | $150 | $130 |

| Entertainment | $100 | $120 |

| Savings | $300 | $300 |

| Debt Repayment | $200 | $200 |

| Total | $2,350 | $2,395 |

Tip: Be realistic. Don’t try to cut too much too quickly. Give yourself room to adjust.

Step 6: Set Financial Goals

A good budget isn’t just about paying bills—it’s also about achieving goals. Ask yourself:

- Do I want to build an emergency fund?

- Am I saving for a vacation or new car?

- Do I need to pay off credit card debt?

- Do I want to invest for retirement?

Set both short-term goals (like saving $1,000 in 3 months) and long-term goals (like buying a house in 5 years). Having clear goals will keep you motivated.

Step 7: Monitor and Adjust Regularly

Your budget isn’t a one-time setup—it’s a living tool. At the end of each month:

- Compare budgeted amounts to actual spending

- Identify overspending areas and make adjustments

- Re-evaluate goals as needed

- Prepare your budget for the next month

Tip: Schedule a “money date” once a week to review your progress. It only takes 15–20 minutes and builds a strong habit.

Bonus Tips to Make Budgeting Easier

1. Automate Savings and Bills

Set up automatic transfers to savings accounts and schedule bill payments to avoid late fees and save consistently without thinking about it.

2. Use Budgeting Tools

Apps like EveryDollar, GoodBudget, or spreadsheets can simplify the budgeting process. Some banks also offer built-in budgeting tools.

3. Plan for Irregular Expenses

Annual fees, car maintenance, gifts, and other non-monthly expenses can ruin your budget if you’re not prepared. Set aside a small amount each month for these.

4. Review Subscriptions

Many people pay for subscriptions they rarely use. Audit your recurring charges and cancel anything unnecessary.

5. Reward Progress

Celebrating small wins—like hitting a savings milestone or sticking to your budget for 3 months—helps keep motivation high.

Common Budgeting Mistakes to Avoid

- Not Tracking Small Purchases: Coffee runs and small online purchases add up fast.

- Being Too Strict: An unrealistic budget can lead to frustration and burnout.

- Forgetting About Fun: Include money for hobbies and enjoyment to stay balanced.

- Not Updating the Budget: Life changes—your budget should too.

- Ignoring Debt: Always make a plan to tackle high-interest debt like credit cards.

Final Thoughts

Budgeting doesn’t mean depriving yourself—it means giving yourself freedom and control over your money. It helps you prioritize what matters, reduce financial anxiety, and make steady progress toward your dreams.

As a beginner, your budget won’t be perfect from day one—and that’s okay. The key is to start, stay consistent, and tweak as needed. Over time, these small steps will lead to big financial improvements.

So grab a notebook, open an app, or fire up a spreadsheet—your financial journey begins today.